The greatest fear of retirement? (It’s not as scary as you think!)

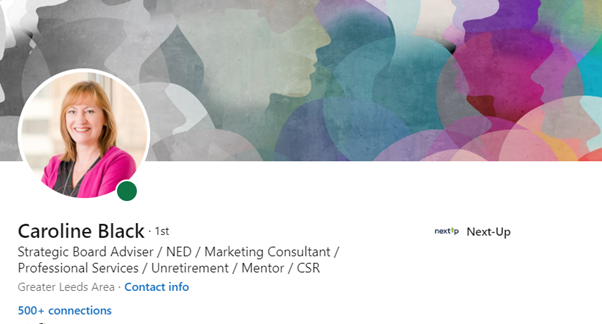

6 September 2022 By Guest writer Caroline Black

Two years ago, I retired. It was one of the hardest decisions of my life. I was scared, worried if I had enough money, if anyone would want me now and if I had just made the worst decision ever.

(Spoiler alert – it was the best decision ever!)

I am now working with Next-Up and passionately believe in what they are doing – helping others to think about their long-term lives and create a happy and successful time after ‘work’. Whatever that means for each individual.

They have asked me to share my thoughts on this process and offer my tips to others. The best thing I did was to get a voluntary role before leaving my corporate job – and that was because I had read some of Next-Up’s blogs and took their advice. And hopefully now I can pass on my tips to others behind me.

Let me start with what I used to do, why I retired early and what my plans were. And then what actually happened and what I have learned on the way.

What was so scary about retirement?

There were three things really worrying me. And these stopped me from enjoying the anticipation of a new life.

My previous job was as marketing director for an international law firm. And that is one of the first big problems about retirement. In this country we are so defined by our jobs. The reality of course is, who cares? But the answer to that is, I cared! And I thought others did too.

At work, my friends had no idea how worried I was and I couldn’t find the words to tell them – or maybe it was pride. They all saw retirement as very attractive and riding off into the sunset to enjoy travelling round the world – looking like an ad for Cunard or Saga. In reality, the fear sets in as the day to retire gets closer and the rosy vision of your colleagues doesn’t take into account your aging parents, your still expensive grown-up children, your pension not being quite what you expected and let’s not mention the ever-moving government pension.

Most of all, the rosy vision doesn’t help you to deal with your biggest fears. What are they? They are money, loss of status and purpose.

These last two are very much part of your personality, psyche and being.

A very respected CEO told me last week he retired for three weeks, got bored and started working again as an advisory chair of a manufacturing company. This gave him the purpose he missed.

What can you do to prevent some of the angst associated with retirement (or what I like to call, unretirement)?

I am not going into detail about money – it is so personal and there are plenty of experts around who are better placed to discuss this. However, I took part in a Next-Up panel for their employee platform and it was interesting that no matter how good a pension or savings anyone had, we were all equals in worrying about money. All I can say is, having really detailed discussions with a financial adviser does help. At least then you are dealing with facts, as much as you can.

But loss of status and lack of purpose are much more difficult to deal with. They are emotive and very personal. I think they are best tackled a few years before you retire when your creativity isn’t clouded by the impending transition.

How can you minimise the fears of retirement?

I am now two years post-retirement. Having reflected on all this and having talked to dozens of others who have unretired, I think there are five things that make the process a bit easier. Some of this I got right, some of it I wish I had done.

1. Voluntary role before you retire

This is the bit I really got right. A few years before retirement, or earlier, start looking for a voluntary role, such as becoming a trustee of a charity. There are always charities, schools and public bodies looking for trustees with different types of experience.

I became trustee Director of a local hospice. I was way out of my comfort zone and into a brand new world of learning. I sat on a number of committees – clinical governance, fundraising, risk and audit and remuneration committees. These broadened my board skills but were also complex and deeply absorbing. It wasn’t long before I realised my voluntary role at the hospice was far more personally rewarding than my paid Director role. It was highly motivating and gave me a strong emotional purpose.

Lucy Kellaway, the FT journalist who became a teacher, gave a TED talk to explain why she became a teacher. She said she had done her job for so long; she had reached the top of the learning curve and possibly was declining in terms of doing her job well. I think many will recognise the point where you know what you are doing at work and, while it may be demanding, it no longer excites or challenges you. Finding something completely new, like becoming a teacher or helping a hospice, gives you a new impetus and energy.

Most importantly, you now have another role to talk about when you retire. It helps broaden your circle of contacts and removes that fear of losing status when you are asked that awful question “so what do you do?”.

2. Be true to your values

This brings me to my second suggestion. Take time to think about your values and where you can offer help reflecting these. In other words, find your purpose – what motivates and drives you? According to the Purpose Exchange “retirement should be a world without boundaries and limitations, where lived experience and wisdom are valued.”

Find a voluntary role or become a mentor in an area which reflects your values and purpose and it will be rewarding. Unretirement is the one time you are completely in charge and it offers a new beginning and opportunities not an end. If something doesn’t fit or feels wrong for you then say no.

3. Write or rewrite your CV

Depending on what you want to do next, you may well need a CV. I can’t tell you how many people say, “I haven’t written a CV since I left school or university”. It can be a painful process at this time of life! Next-Up can help with this and they say the biggest issue for most, is you want to talk about what you have ‘done’ (apparently some six pages at times!) when what you need is to pull out your experience relevant to this new world.

That means recalibrating and rewriting your CV to reflect what you want to do rather than your past career. Your executive roles are important for experience but building a CV with non-executive, trustee, voluntary and mentoring roles takes you into a different dimension. Particularly if you are looking for board or non-exec roles. Once it is rewritten, test it on trusted friends and mentors who are active in this world and keep it up-to-date as your transition develops.

4. Create a presence on LinkedIn

Alongside your CV, it’s a good idea to update your LinkedIn profile – or create one if you haven’t been a fan. It’s the first thing people look at when they introduce you and to be honest, I think you look slightly outdated (or maybe aloof?) if you don’t keep it relevant and current.

5. New connections – lots of them and it’s fun

Network, network and network. Be open to all opportunities and conversations and get involved in supporting others. It is surprising where people need help and one thing leads to another – through people you know and who respect you. Never turn down the chance for a coffee and don’t be a network snob – treat people as individuals not job titles.

Next-Up suggests doing all this in a structured way, and focusing on having 20 conversations – 50 or more if you can. I know some of my old colleagues are surprised at the completely new world I have created, quite quickly. I accept I have been lucky, but I have also worked extremely hard at this and listened to a lot of advice from many generous people. It has not landed in my lap.

When I was thinking about this next stage, I identified a dozen people who were themselves active networkers and doing interesting things or trying to do these. I worked hard at staying in touch with these people – and they are where my opportunities have come from. I am now doing a mix of paid and voluntary work. The paid work is consultancy and projects, helping businesses with a particular challenge. They get to know you, understand your strengths and you are on hand when much bigger projects or roles come along.

I am now at the stage where I feel very blessed and am having an absolute blast. I have a great mix of roles and work but also time to enjoy myself, have fun and spend time with my family. It is the work/life balance that is much talked about but so difficult to achieve. I don’t think I have ever been as happy or fulfilled, learning all the time and feeling I am making a difference – I have found purpose in my life.

The challenge of unretirement is that there is no neat handbook to guide you. Some of it is trial and error and happenchance. But put your heart into it and you can create the best time of your life.

Good luck if you are starting on your own path!

PS One of the roles I now have is with Next-Up, working with professional firms to help partners pre-retirement. We even run a Professional Services Retirement Forum to share HR learning. Love to share what we are doing if you are interested.